How to Register for Absa Bank Internet Banking. In today’s digital world and especially in the 2023 and Pro Covid-19 Pandemic, online banking has become an integral part of our daily lives. With the convenience of managing your finances from anywhere, anytime, online banking has gained immense popularity across the world. Absa Bank, one of the leading banks in Kenya, offers an Internet Banking service that provides customers with a safe, secure, and convenient way to manage their finances online anytime and everywhere. In this article, I will categorically provide you with a step-by-step procedure on how to register for Absa Bank Internet Banking in Kenya so sit back and enjoy the content.

How to Register for Absa Bank Internet Banking

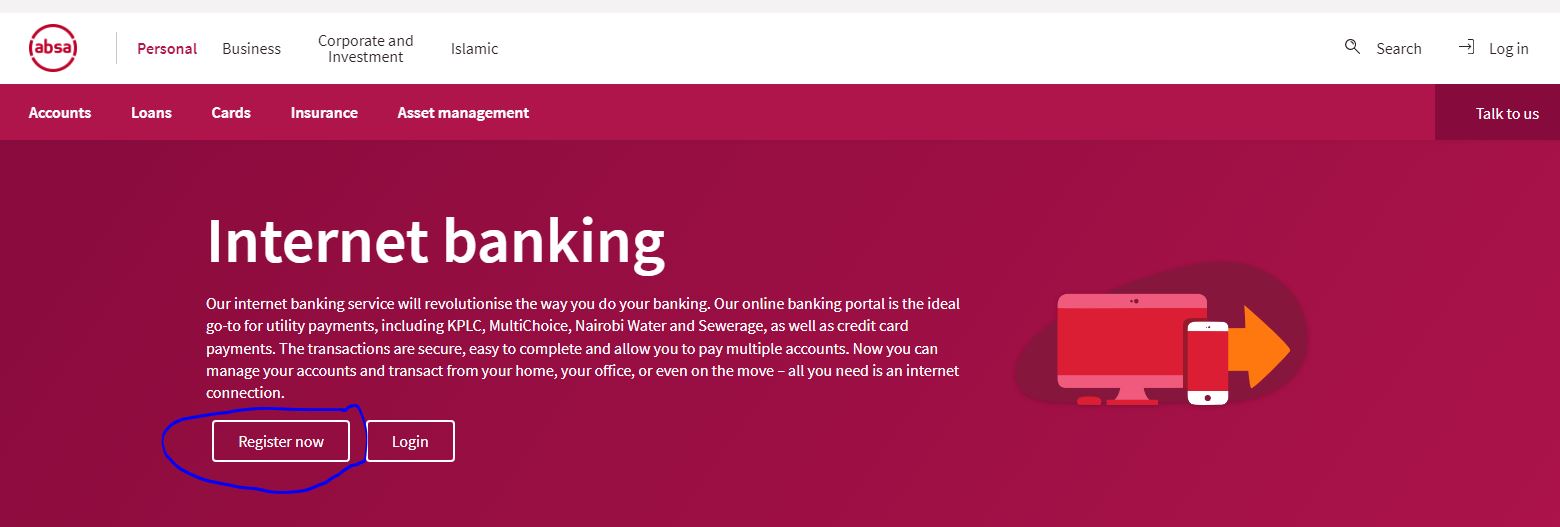

Step 1: Visit the Absa Bank Kenya website Visit the official Absa Bank Kenya website at www.absabank.co.ke. Once you are on the homepage, click on the “Register Now” button located on the home page.

Step 2: Click on “Register” On the login page, click on the “Register” button located just below the log in fields. This will take you to the registration page.

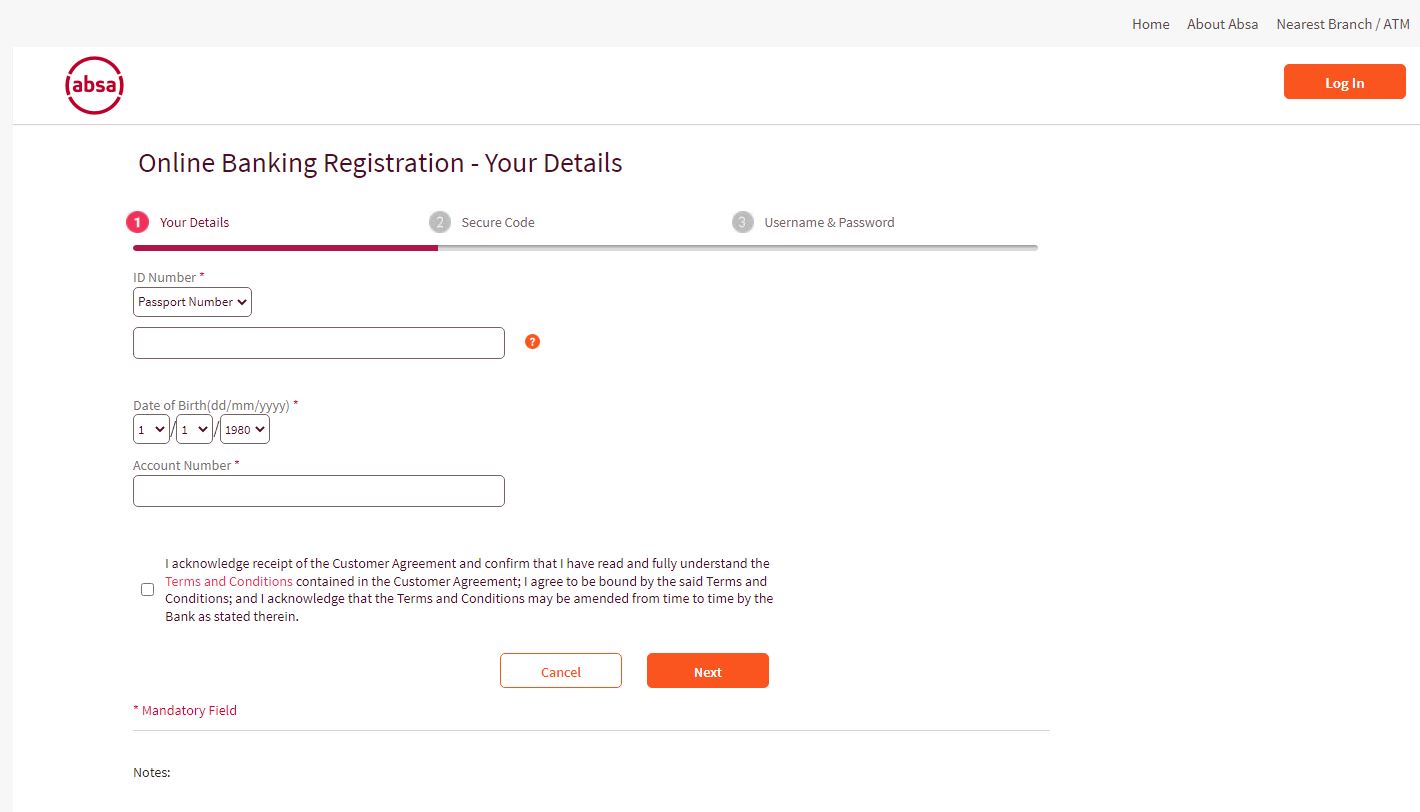

Step 3: On the Registration page you will be asked to provide your Personal information in the “Online Banking Registration – Your Details” section, choose the ID number method in the Drop down list, Date of Birth , and account number, and then you will tick the “Terms and conditions ” box to accept the “Terms and conditions of the Bank.

Step 4: Once you have entered all the required information, click on the “Next” button.

Step 5: Choose your username and password You will now be prompted to choose your Internet Banking username and password. Your username should be unique and easy to remember, (remember never to share this information with anyone) and your password should be strong and secure mostly a combination of Letters, Symbols, and numbers. You will also be asked to confirm your password. Once you have chosen your username and password, click on the “Next” button. At this stage, you are almost halfway to knowing How to Register for Absa Bank Internet Banking.

Step 6: At This step, Verify your email address and mobile number Absa Bank will send a One Time Pin (OTP) to the email address and mobile number that you have provided. Enter the OTP on the registration page to verify your email address and mobile number. Once you have entered the OTP, click on the “Next” button.

Step 7: Security Question: Set up your security questions You will now be prompted to set up your security questions. These questions will be used to verify your identity in case you forget your username or password. Choose the questions and provide the answers, and then click on the “Next” button. Make sure you write questions that you can remember easily.

Step 8: Complete the registration process . After you have set up your security questions, you will be later taken to a confirmation page that confirms your successful known How to Register for Absa Bank Internet Banking. Click on the “Finish” button to complete the registration process.

And Viola! Congratulations! You have successfully registered for Absa Bank Internet Banking in Kenya. You can now log in to your account using your username and password to enjoy the benefits of Absa Bank’s Internet Banking service, such as checking your account balance, transferring funds, paying bills, and more.Wasnt that easy? follow the above process.

Benefits of Absa Internet Banking

With Absa Internet Banking you can be able to do the following :

- View your account information.

- View, download, and print your statements.

- View, download, and print proof of payment.

- Transfer funds between your Absa accounts and other Absa accounts or even accounts at other banks (RTGs or/and PesaLink)

- View your credit card statements.

- Link your accounts (both credit card and additional bank accounts).

- Carry out foreign exchange transactions.

- Pay your utility bills, purchase airtime, and load MPESA and Airtel Money.

- Query foreign exchange and interest rates.

- Send and receive emails to and from Absa.

- Access your account 24/7 from anywhere in the world.

- Request for a checkbook

- View your Loan Account details

- Create a travel notice to enable your Absa Cards for global transactions

- Debit card and One-time password (OTP) presence management

Conclusion:

Registering for Absa Bank Internet Banking in Kenya is a simple process that can be completed in a few easy steps. By following the procedure outlined above, you can easily register for Absa Bank Internet Banking and enjoy the benefits of online banking, such as 24/7 access to your accounts, convenient bill payments, and easy money transfers. With Absa Bank’s Internet Banking service, you can manage your finances securely and conveniently from anywhere, anytime. So, whether you’re at home or on the go, you can stay on top of your finances with ease. Don’t wait any longer, register for Absa Bank Internet Banking in Kenya today and take control of your finances with just a few clicks!