Transaction Cost From Mpesa to Equity Bank .M-pesa is a microfinance and mobile money transfer system launched by Vodafone and developed by Safaricom and Vodacom, the two largest cell phones operators in Kenya and Tanzania. It is the most trusted service in Tanzania with over 5 million Tanzanians using M-pesa.M-pesa grew rapidly and by 2010 had become the most successful mobile phone-based financial service in the developing world. By 2012, approximately 17 million of accounts have been registered in M-pesa Kenya. The service has been praised for providing millions of people with access to the “formal” financial system. It has also helped reduce crime in societies largely based on cash exchanges.It has since expanded to Afghanistan, DR Congo, South Africa, India and, in 2014, Eastern Europe.

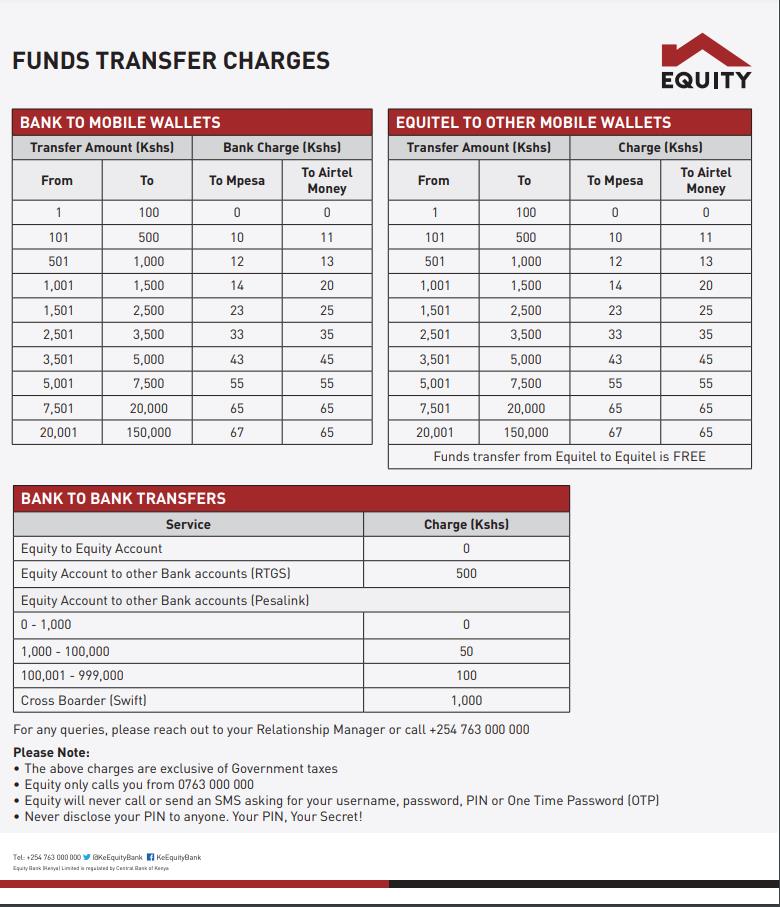

With M-pesa, you can easily send or receive money from over 160 countries instantly to and from your M-pesa wallet through a wide range of partner globally.In 2023 Mpesa to Equity Bank Kenya transactions were re-introduced this means that now you will have to pay when transferring cash from Mpesa to Your Equity Mobile Bank. This transaction charges cuts across all the Transactions. As from January 2023 ,you will be charged the following to transfer money from Mpesa to bank .

Transaction Cost From Mpesa to Equity Bank.

The Below Chart shows Transaction Cost From Mpesa to Equity Bank.

Equity Bank History

On 31st December, 2014, Equity Building Society, as it had previously been known as, became Equity Group Holdings Limited, a non-operating holding company, after undergoing a process of restructuring, so as to further meet its objectives. In 1984, Equity Building Society -now the bank arm of the group- was founded, and has recorded various key milestones through the years. In 2004, it converted into a fully-fledged commercial bank, Equity Bank Limited (EBL). It was listed in the Nairobi Securities Exchange in 2006, becoming the largest bank by market capitalization, and attracting Helios, a strategic investor, who invested USD 185 million in 2007. Support such as this has seen the scaling and transformation of the Group into a rapidly growing Pan-African banking group, and in the process inspiring many.

The Group has over time established itself as a Social and Economic brand, scaling on both fronts, owing to its unique approach. The Group has impacted the lives of people in communities, at grassroots level by operating using existing infrastructure, strategic partnerships and a strong brand. Its strategic initiatives and innovations are geared towards improvement of access, convenience and affordability of financial services to people. This has seen the group grow into a regional diversified services firm, while maintaining an impressive growth momentum and upward trajectory. The Group has set itself apart as a financial services provider, establishing itself as the leader with a strong base for Pan-African growth and thereby becoming a movement for social economic transformation of the African people. The Group’s greatest challenge presents the greatest opportunity; to meet the expectations of all customers and stakeholders in this region.

In 2015, the Group commenced operations in the Democratic Republic of Congo through the acquisition of Pro-credit Bank, a milestone that set a benchmark and propelled them towards enhancing its reach and furthering its financial inclusion agenda. This move was in line with the Equity 3.0 strategy and was part of the commitment to deepen financial inclusion in Africa. By executing the Equity 3.0 strategy, the Group is able to leverage on breakthrough technology and innovation to achieve a convergence of financial products and services, in addition to seamlessly integrating the channels. The Group has forged a well embraced, purpose-driven and community centered culture that works in tandem with it’s compelling vision of being the champion of socio-economic prosperity of the people of Africa. This way it has transformed itself from a small building society into the leading financial services Group in the region and one of the most powerful brands in East and Central Africa.

The Group, through The Equity Group Foundation, continues to capitalize on Social and Impact Investments, a move whose success was evidenced by the growth of its customer numbers to over 10.1 million by the end of 2015. Such initiatives include transformation and modernization of agriculture through agribusiness activities, micro-business enhancement through financial literacy and entrepreneurship training, inclusion through social payments and development of ethical leaders through scholarships under the Wings to Fly scholarship and Equity Leaders Programs.

Since 2016, the Group has continued to capitalize on the opportunities that ensure that Kenya is positioned as the hub for financial services in the region. Efforts to achieve this are fueled by offering differentiated, high quality offerings driven by segmentation and cross-selling initiatives and responsiveness to the needs of the customers across the different segments.

Source : https://equitygroupholdings.com/our-history/