How to change tax obligation on itax.What is a Tax obligation?Tax Obligation means a duty or obligation to pay all applicable taxes, interest, penalties and costs of collection.While applying for the KRA PIN, you will be required to select a tax obligation. These tax obligations include:

Income Tax

- This is a Compulsory obligation that applies to either residents or non-residents. This particular obligation is payable every year.In most cases in Kenya, people File their yearly returns in june every year.However,the Tax returns filing window is open every year from January .If you are employed ,you may need to ask your accountant for a P9 form. A P9 form shows how KRA deducted your Taxes from your Salary in that particular year

Value Added Tax (VAT)

- This kind of Tax Applies to suppliers of taxable goods and services. Value Added Tax (VAT) is charged on: Supply of taxable goods or services made or provided in Kenya, and; Importation of taxable goods or services into Kenya.This type of Tax is Calculated every 9th Day of the Month.The penalty for filing this Kind of Tax is Ksh 10,000 for every failed month.To avoid this you better file your Taxes!

Pay As You Earn (PAYE)

This Kind of Tax Applies to employers ,its a method of collecting tax from individuals, both Resident and Non-resident, in gainful employment. Gains or Profits includes wages, casual wages, salary, leave pay, sick pay, payment in lieu of leave, fees, commission, bonus, gratuity, or subsistence, travelling, entertainment or other allowance received in respect of employment or services rendered.

How to change tax obligation on itax

In the below article ,I will show you simple ways of How to change tax obligation on itax.The process is simple and these are the requirements you need to know How to change tax obligation on itax.

- You will need a computer with internet .

- You will need to have your KRA Itax logins i.e the KRA Pin E.g A00458723K

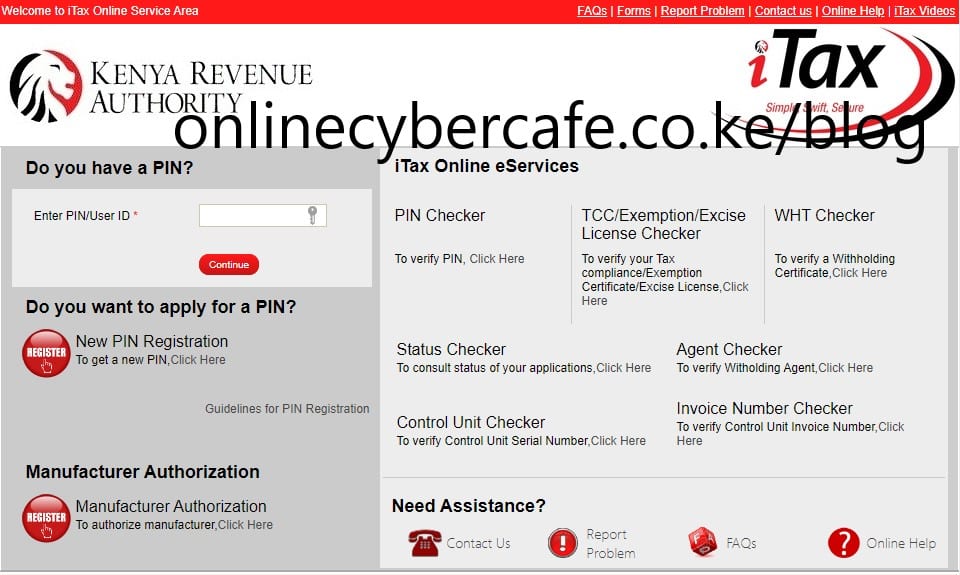

- First ,you will need to go to your browser and go this Link KRA Itax Home Page

- After Inputting your User ID /PIN and putting your Password ,you will see the KRA dashboard .Go to “Amend Pin details” on the upper part of the Menu. Here you will be able to amend your Pin details if you didnt have any obligation on your KRA PIN.This applies to students and people who have no gainful experience or earning anything and hence they cannot earn any money to file returns.

When you click on “Amend Pin Details”,you will see a e-Amendment of Registration form where you will be able to see how to choose the Kind of form you will use on How to change tax obligation on itax.Refer to the below image.

The next tab will show you different tab on the main menu of the part to amend PIN details ,You will click on “Obligation Details ” tab so that it can take you to the Tab where you will actually show you How to change tax obligation on itax.See the Figure below.

The next tab will show you different tab on the main menu of the part to amend PIN details ,You will click on “Obligation Details ” tab so that it can take you to the Tab where you will actually show you How to change tax obligation on itax.See the Figure below.

On the next tab you will see different fields,you will see the “E-Ammedment of registration ” tab,click on it which will take you to the page on where you can change your obligation details .See the figure below

READ ALSO :How to change tims account password-5 Easy steps

On the above tab click on “next” ,this will take you to the Page where you are supposed to change the obligation you qualify in.These obligations are VAT,PAYE or Turnover tax.Click on the box to highlight the tax obligation you want to update and click on the date of registration next to it.See figure below